Key Differentiators & Benefits

Speak to Our Team TodayReal-Time Payments with Full Compliance

Our systems support real-time transaction processing with built-in tokenisation and full adherence to PCI-DSS standards, ensuring secure and compliant payment handling.

Flexible Payment Options Across Currencies

We enable seamless payments through cards, digital wallets, and direct bank transfers—supporting multiple currencies for global transactions.

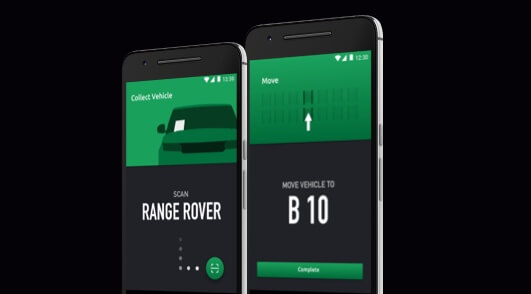

Trusted by Leading UK Enterprises

Top UK brands such as Jaguar Land Rover and Hammonds Furniture trust our payment infrastructure to support their high-volume, mission-critical operations.

Secure, Scalable Payment Architecture

Built for growth, our payment platforms feature advanced fraud detection, encrypted data processing, and scalable infrastructure designed for enterprise performance.